Home / Insights / White Papers / Cybersecurity & Threats: Individuals and Families

In recent years, the landscape of individual and family cybersecurity has seen significant change with a marked increase in threats. As cyber criminals become more sophisticated, the necessity for personal cyber insurance has grown. To defend against these threats, it is crucial to stay informed about the latest cybersecurity practices and to implement measures such as using strong, unique passwords, enabling two-factor authentication, and keeping software up to date. In addition to these pro-active measures, personal insurance providers are now offering insurance coverage to transfer some of the cyber risks if these cybersecurity practices fail.

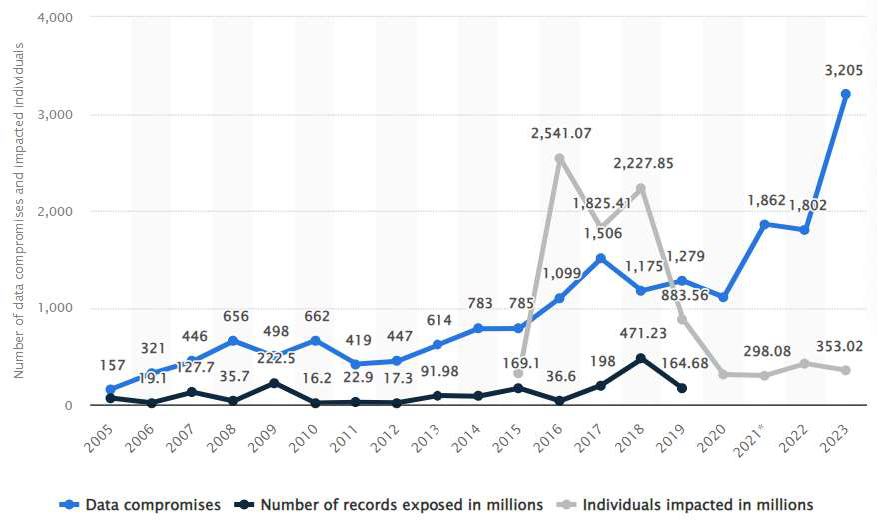

In 2023, the U.S. saw 33,561 claims reported for cyber related attacks. This trend highlights the heightened awareness and need for protection against cyber risks among individuals as exemplified below with data compromises increasing since 2020.

Cybersecurity agencies like the Cybersecurity and Infrastructure Security Agency (CISA) have reported that millions of individuals are vulnerable to cyberattacks, which can range from data theft and ransomware to more personal attacks aimed at causing distress. In 2025 so far, there have been over 7.5 million recorded cyber incidents globally, compared to 6.3 million during the same period in 2024.

Understanding and identifying cyber threats is the first step towards avoiding cyber fraud. Armed with pro-active monitoring services and personal cyber insurance, individuals and family’s can prepare and protect themselves from becoming a victim of a cyber incident in our evolving virtual world.

A few examples of cyber threats posing significant risks to individuals and families include:

![]()

Social engineering tactics, which are particularly prevalent, exploit human psychology and trust in others to extract sensitive information. These can include phishing attempts, where attackers masquerade as trustworthy entities to deceive people into providing personal data or wire money to a fraudulent account.

![]()

Ransomware attacks, which involve malware that encrypts a victim’s files and demands payment for their release, have seen a dramatic increase and can cause severe disruption in one’s life.

![]()

Vulnerabilities in third-party services and cloud storage can expose personal information to unauthorized access. Attacks on “Internet of Things” devices (ex. “smart” devices) also represent a significant threat, as many households are now connected to the internet and can be compromised granting access to a family’s private network.

The statistics surrounding the growing cyber insurance market indicate a shift in the perception of cyber risks, with more people recognizing the importance of safeguarding their digital presence. As such, personal cyber insurance has become a useful tool in mitigating the financial repercussions of cyber incidents for individuals.

“a recommended approach to aid in preventing a cyber breach is the combination of a monitoring app with a cyber insurance policy”

Many personal lines insurance carriers have sought to address the evolving threat environment by offering cyber protection by endorsement onto their homeowners policies. Aside from educating oneself and staying up to date on the creative ways cyber criminals are attacking individuals and families, a recommended approach to aid in preventing a cyber breach is the combination of a monitoring app with a cyber insurance policy.

Monitoring apps act as another line of defense against a cyber threat while insurance allows for a backstop in the event the app and any other precautionary measures fail. In the event of a “covered breach” (as defined by the insurance contract), the policy reacts accordingly covering identity theft expenses, data recovery costs, or ransomware payments to name a few.

As the marketplace for personal cyber insurance expands, policy contracts, available limits of coverage, eligibility and pricing will vary by company. EPIC recommends speaking to a licensed property & casualty professional to discuss options when purchasing an insurance policy and what limits of coverage are recommended based on one’s risk profile.

As a rough guideline, contributing factors to take into consideration when determining how much coverage to purchase include the volume and size of online financial transactions as well as the ages of those in the household. The most recent cyber crime victim data as of 2023 shows roughly 20% were less than thirty years old while 25% were over the age of sixty. Both groups may find themselves less educated on the latest cyber threats however the younger generation presents a greater risk due to their willingness to trust while the older generation is more susceptible to social engineering.

| Coverage Limit | Average Cost |

|---|---|

| $25,000 | $100.00 |

| $50,000 | $150.00 |

| $100,000 | $250.00 |

| $250,000 | $550.00 |

| $500,000 | $1,250.00 |

| $1,000,000 | $2,500.00 |

| $2,000,000 | $4,500.00 |

Cyber criminals will continue to find sophisticated ways to disrupt the lives of individuals and families. Mobile-related attacks surged by 22% globally, fueled by hybrid work and device vulnerabilities. These attacks can be repelled through education, insurance protection and pro-active risk mitigation using monitoring services and strong cyber hygiene.

- Published by Ani Petrosyan, S., & 12, F. (2024, February 12). Number of data breaches and victims U.S. 2023. Statista. https://www.statista.com/statistics/273550/data-breaches-recordedin-the-united-states-by-number-of-breaches-and-records-exposed/

- Cyphere. (2023, November 27). Cyber Insurance Statistics – payouts, claims and facts. https://thecyphere.com/blog/cyber-insurancestatistics/#:~:

text=Around%2010%2C100%20first%2Dparty%20cyber,cyber%20insurance%20policies%20in%202021 (No longer available) - Vigderman, A., & Turner, G. (2024, June 3). Cyber Insurance Statistics and data for 2024. Security.org. https://www.security.org/insurance/cyber/statistics/

- Published by Ani Petrosyan, & 3, A. (2024, April 3). U.S. cyber crime victims by age 2023. Statista. https://www.statista.com/statistics/1390164/us-victims-cyber-crime-by-age/

- National Association of Insurance Commissioners. (2024). Cyber insurance report. https://content.naic.org/sites/default/files/cmte-h-cyber-wg-2024-cyber-ins-report.pdf

- SQ Magazine. Cybersecurity Attacks Statistics 2025: Trends, Costs, and Implications. Retrieved from https://sqmagazine.co.uk/cybersecurity-attacks-statistics/