Viewpoints from Dan Grelecki

As younger generations come into the workforce, hiring and retention practices have had to evolve beyond what they were for their parents and grandparents.

Our employee surveys are showing that other benefits aside from health insurance are starting to gain momentum. Aspects such as flex time, flexible space, leave benefits, family care, career development opportunities, are all things that in our surveys, year after year over the past decade, just keep steadily increasing.

The newer generation of people you’re trying to recruit and retain want more choices and more say in selecting the benefits that fit them best.

They say, “I want to pay my money, and I want to get what I want whenever I want it.”

Thanks to ICHRAs, employee benefits’ role in retention has recently taken a giant leap forward by helping employers be more strategic about funding the cost of employee benefits while giving employees more plan choices and flexibility than they’ve had in a long time.

A game changer

ICHRA stands for an Individual Coverage Health Reimbursement Arrangement.

- ICHRAs emerged in 2020

- The HRA funding mechanism reimburses employees with pretax money for qualified individual health plan premium expenses

- A defined employer contribution and extensive employee choice are its hallmarks

- It’s like a 401(k) plan, but for health insurance

Who’s a good candidate, and what are the advantages?

Most of our clients who have taken advantage of this offering have as few as 30, and as many as 1,000, covered lives and are from an array of industries. Many of these clients previously experienced an increase in rates and overall costs due to negative claims experience. Here are a few situations where an ICHRA could be a great fit:

- Golden Parachute – community rating in large group market

- When single-digit predictable increases are desired

- Widespread geography where employees have different expectations

- When an employer doesn’t meet participation requirements

- When defined contribution and choice align with organizational philosophy

If you have a finance leader who’s said something like, “Can I just give someone money, and let them go get whatever they want?” this is the answer.

It’s also a fit for the member who says, “Can’t they just give me the money, and I’ll go get whatever I want?!”

Looks and feels like a group health plan…with more flexibility for the employee

ICHRAs are ACA-compliant (we’ll help you navigate the discrimination rules) and the look and feel is much like that of a group health plan. Employees can either waive the health reimbursement account or buy the plan from the company of their choice. The employer funds the HRA, and employees choose what they want and enroll in a plan. We partner with technology firms to take the payment information and send it to the carriers on behalf of employees.

Employees appreciate the opportunity to choose a plan that best fits their needs. People who are comfortable taking on a little more risk for the opportunity to keep more in their paycheck can buy down and spend a lot less. Others may choose to pay more to get more. All have the flexibility to consider their circumstances and select the best option for them.

Real World ICHRA Premium Savings

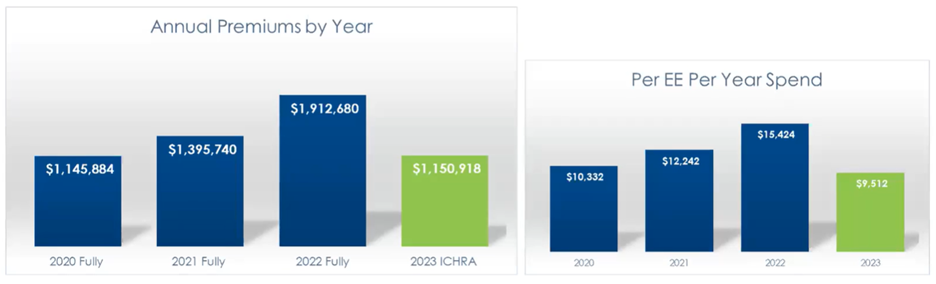

A fully insured client from Illinois came to us with a challenge. They were spending almost $2 million a year on their mostly female workforce, spread out in 35 counties across multiple states. The population is a relatively unhealthy group with multiple major ongoing conditions.

The client wanted to take their total premium dollar amount back down to their 2020 rate of $1.1 million annually. They were able to achieve their dramatic plan savings goals with the age- and geography-rated ICHRA.

If you have an unhealthy group, especially if it’s a young, unhealthy group, this might be an excellent solution for you.

The future is bright for ICHRAs, and the momentum is growing. A defined employer contribution—with a lot of choice for the employee—is a win-win that is being embraced more and more and has a bright future. It’s non-partisan, and states are even beginning to offer ICHRA tax credits for small businesses.

Working for you at the intersection of cost and culture

Our job as your employee benefits advisor is to build a plan at the intersection of cost and culture that is tailored to you and your employees, whether you’re in the same location or remote and spread out across the country.

Your EPIC advisor uses sophisticated technology and modeling that allows us to apply your desired outcome with your population’s health, age, and geography to determine your optimal path to your ideal offering and savings.

We look forward to showing you an effective way to create a truly new, engaging, and unique employee benefits package to attract the kind of people you want to recruit and to keep the kind of people you want to retain.

EPIC offers this material for general information only. EPIC does not intend this material to be, nor may any person receiving this information construe or rely on this material as, tax or legal advice. The matters addressed in this document and any related discussions or correspondence should be reviewed and discussed with legal counsel prior to acting or relying on these materials.

Fill out this short form to download your copy of our EPIC Individual Coverage HRA Solution overview and learn how we can help support sustainable savings and predictable year-over-year costs on your health benefits.“*” indicates required fields

Related Content

Products

Employee Benefits Consulting

Our dedicated benefits team is focused on delivering better outcomes – to both your benefits program and ...

Products

Actuarial

Our Actuarial Team provides guidance on employee benefits and health and welfare programs to help meet ...

Products

HR Technology Solutions

From advising startups on how to build a solid Human Resources (HR) infrastructure, to consulting with ...