Viewpoints from Renee Bosley

If you’re an employee benefits professional who currently uses the fully funded strategy for healthcare insurance – or are self-funded, but without a captive – this message is for you.

We know that you’re feeling the pressure from recent renewal rate increases. After a bit of a lull in rate increases due to the pandemic and lower utilization, both members and carriers are making up for lost time! Add inflation into the mix, and you’re ready to start considering other creative options to fund the cost of your employee benefits. If you’re finding that changing carriers and changing plans are not getting the cost savings you need, read on.

Allow us to introduce you to captives.

Captive insurance is a smart option in a self-insured strategy that both insures your risk and returns profits to you. Sounds great, doesn’t it? Instead of a traditional insurance carrier keeping the profit on your employee benefits, you do. Even better, as a self-insured captive insurer, you actively participate in decisions influencing underwriting, operations, and investments. And you’re not alone because you have individual and aggregate protection with other like-minded companies to share the journey and the risk with.

Whether you’re already self-funded, or you’re fully insured, here are five reasons why you should consider captives:

- Stabilize costs without the need for major annual plan changes

There’s no need to play fruit-basket turnover with your plan from year to year trying to uncover savings, because you’ll be able to structure and customize your offerings to meet your population’s needs right from the start. You decide what your plan will cover, based on what your employees need. - You profit instead of the carrier and stop-loss carrier

When you join with other employers to combine forces, you benefit from group purchasing economies of scale which smooths risk. - Business intelligence and transparency

With access to robust analytics and the expertise to understand them, you’re empowered to measure risk and vendor performance so you can make educated, informed decisions. No more feeling like a victim of the black box. You receive the information you need to manage your costs and understand the impact. - Sharing of ideas and best practices

Not only do you pool your money and pay claims together, but you’re paired with like-minded companies to share knowledge and wisdom for the most effective and efficient decision-making. - Implement your own customized cost management solutions

For example, if you have a population with a high rate of diabetes, you can factor that into your funding solution. Your tailored offering would include special deals and provisions for the provider network and PBM for meds and other diabetic supplies. You can choose your best and most effective offerings.

Captives are not just for large employers.

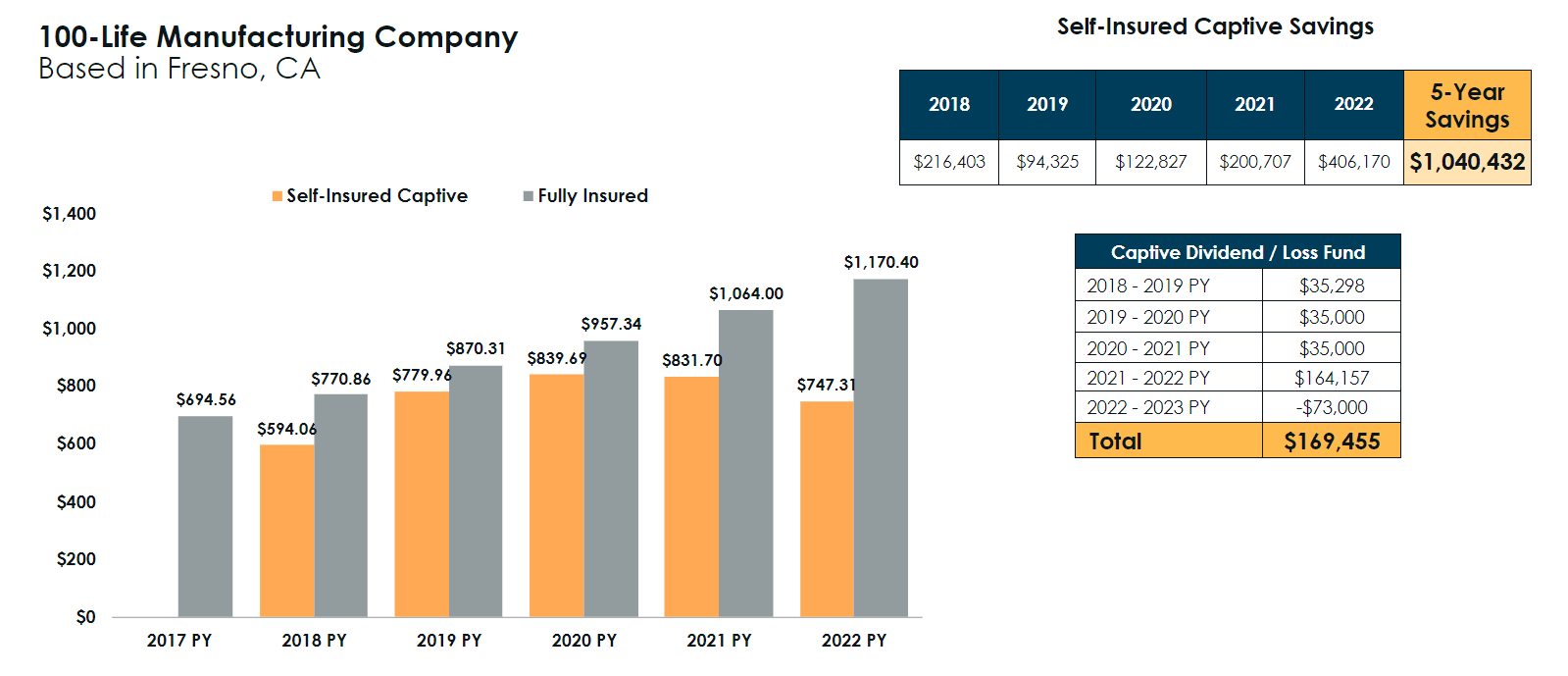

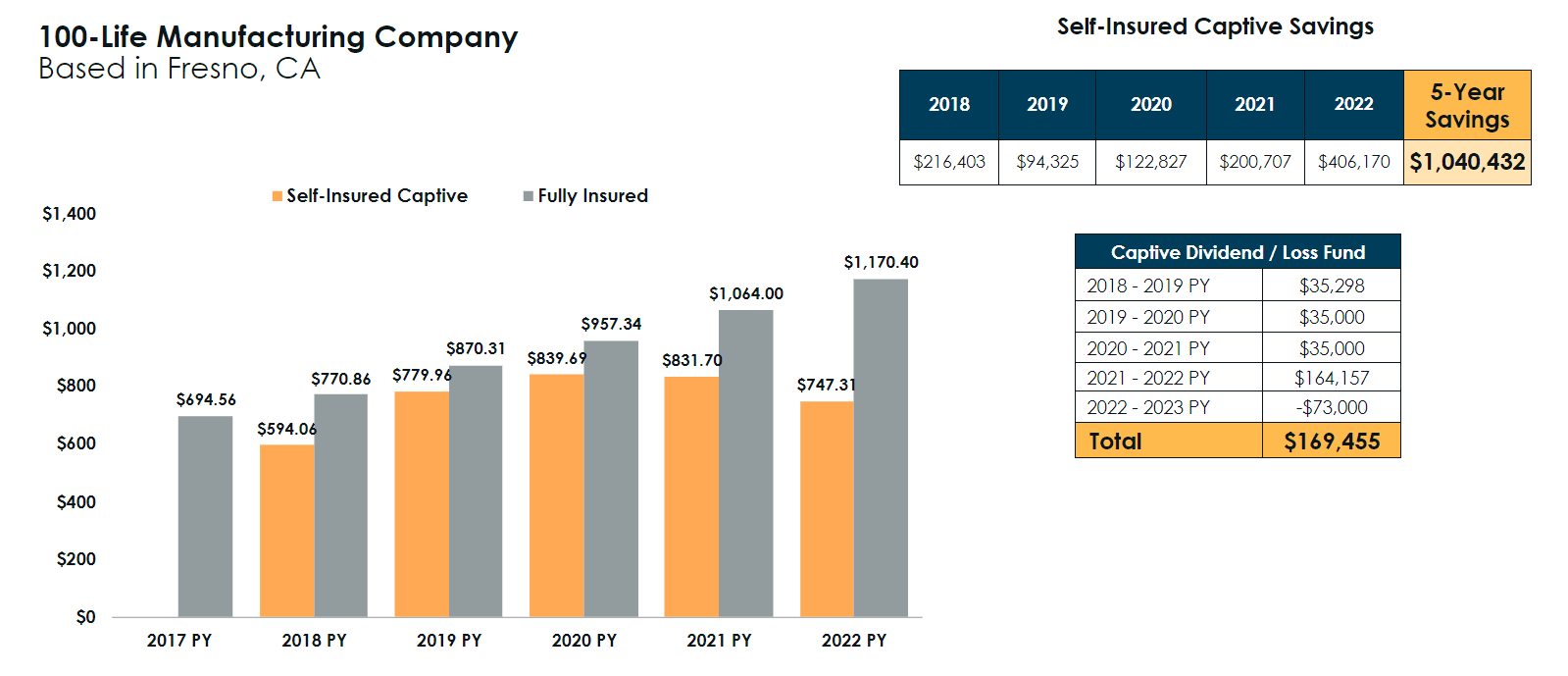

A picture is worth a thousand words. See below for a real-world example of a client’s medical and pharmaceutical total spend over five years, from the time they chose to incorporate a self-funded/captive strategy. They are a manufacturing client in California, with 100 covered lives. The comparison shows that in 2017, they were fully insured and paid $694.56 per member. The next year, they became self-insured with captive insurance, and their per-member cost decreased by about $100 per member. Through the years, their effective renewal rates increased, but at a much slower pace than they would have if they had stayed fully insured.

After five years, they had saved more than one million dollars, in addition to their captive profits!

This employer was able to add more plans to their benefits offering, plans that were targeted to their specific population. In cost sharing, some employees are willing to pay less for less, and some employees are willing to pay more for more; one size does not fit all. A captive program is customizable and flexible.

It’s natural to have reservations about change.

We get it if you’re skeptical or you feel as if you’re too busy to explore this option. We really do. But playing it safe is sometimes the riskiest choice when it comes to serious business, like finance and healthcare. If you would like to lower your costs by increasing your purchasing power, and if transparency is important to you, a captive arrangement is your is your way to smooth risk and reduce the effects of inflation.

Your EPIC broker was made for this. We have the expertise – and the data and analytics – to evaluate your unique situation and determine the right path for you by designing a plan around your and your members’ needs.

Download Now: EPIC Captives Solutions Overview

Related Content

Products

Employee Benefits Consulting

Our dedicated EPIC benefits team is focused on delivering better outcomes – to both your benefits program ...

Products

Actuarial

Our Actuarial Team provides guidance on employee benefits and health and welfare programs to help meet ...

Products

Pharmacy Solutions

Our pharmacy experts work with the health and welfare teams to deliver certainty and direction for your ...